February 2020 Update: Lease Standard: Topic 842 Delayed

On Nov. 15, 2019, the U.S. Financial Accounting Standards Board (FASB) voted to delay the effective date for the new lease accounting standard. Non-public entities must apply the new lease accounting standard beginning after Dec. 15, 2020.

Take this extra time to get ready for implementation. Make a list of all the leases that the Organization has and note general information about the lease, such as lease terms, duration, payment terms, etc.

Read more about the New Lease Standard (ASU 2016-02) in the following article.

The effective date for ASU 2016-02 Leases is just around the corner. For non-public entities it is effective for periods beginning after December 15, 2019, which would be an organization’s December 31, 2020, year end for calendar year-end organizations. Early adoption is permitted.

Now is the time to get an understanding of what your organization needs to do to prepare for implementation.

We all wonder why there is a need for a new standard. The lease standard was created due to the Financial Accounting Standards Board (FASB) noting that over $1 trillion of leases for publicly traded companies were not recorded on the balance sheet and IFRS citing over $3 trillion worldwide companies for having lease commitments that were not presented on the balance sheet.

With the exception of leases with a term of 12 months or less, all leases should be accounted for on the statement of financial position under the new lease standard. Previously, operating leases were only required to be disclosed in the footnotes to the financial statements.

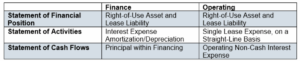

The accounting for finance leases does not change. The accounting for operating leases, however, does.

Below is a table to show where each type of lease, finance and operating, need to be shown in the financial statements:

A right-of-use-asset is defined as the initial amount of lease plus any payments made to the lessor before the lease was in place, plus any direct costs to put the lease in place, minus any incentives that the lessor may have given to the lessee. The right-of-use asset is initially measured at the present value of the lease payments.

The lease liability is defined as the present value of the lease payments discounted by the implicit interest rate at the time the lease rate is readily determinable. If the rate is not determinable, the lessee will use its incremental borrowing rate (the interest rate that the lessee would have if he/she borrowed the money to pay for the lease).

- Familiarize yourself as to what the definition of a lease is per the FASB.

- Create a list of the leases your organization has, including the terms of each lease.

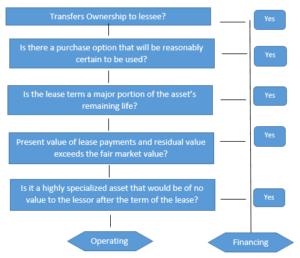

- Determine if your leases are operating or financing leases.

- Decide if any of the leases are less than 12 months.

- Here is a table showing the criteria needed to be classified as a finance (previously called capital) or operating lease.

If you have any questions about ASU 2016-02 (topic ASC 842) and/or ASU 2018-11, please contact your Hawkins Ash CPAs representative.